How to Make a Family Budget Spreadsheet for 2025

January 8, 2025

Creating and maintaining a budget is one of the most effective ways for a family to manage their finances, set goals, and prepare for the future. A well-structured budget helps ensure that income is spent wisely, debt is managed, and savings goals are met. While there are countless budgeting tools available, a personalized budget spreadsheet can be a simple yet powerful way to stay in control of your finances.

In this guide, we will walk you through the steps of building a family budget spreadsheet that’s easy to use, intuitive, and effective. We’ll include key categories, formulas, and examples to make the process clear and actionable, while also providing insights into advanced strategies that can optimize your financial plan.

Why You Need a Family Budget Spreadsheet

A family budget spreadsheet offers a clear, organized overview of your financial situation. Unlike paper budgets or scattered apps, a spreadsheet offers flexibility, data analysis, and easy adjustments. Using a budget spreadsheet can help you:

Track spending: Visualize where your money goes every month.

Control expenses: Prevent overspending in certain areas.

Save effectively: Ensure you’re allocating enough towards savings, retirement, and emergency funds.

Prepare for the future: Plan for large expenses such as tuition fees, vacations, or a new home.

Pay down debt: Prioritize high-interest debts and get a clear picture of how much is owed.

In short, a well-designed budget spreadsheet is an indispensable tool for financial health and stability, allowing you to take control of your finances and plan for your family's future.

The Structure of Your Family Budget Spreadsheet

Before we dive into the details, let’s set up the framework for the spreadsheet. A family budget spreadsheet should include several sections:

- Income

- Fixed Expenses

- Variable Expenses

- Debt Payments

- Savings & Investments

- Summary

These sections provide a comprehensive view of your financial picture and help ensure that every dollar of your income is properly allocated. Let’s go through each of them in detail.

Step 1: Income

The first step in creating a budget spreadsheet is to track your income. For a family, this will typically involve the salaries of both parents, along with any additional sources of income, such as freelance work, investments, rental income, or child support.

Excel formula for total income: =SUM(B2:B4)

By summing the various income sources, you get the total monthly income. Be sure to adjust these numbers if one of you works part-time or is on a temporary leave.

Step 2: Fixed Expenses

Fixed expenses are those that remain constant from month to month. These include rent or mortgage payments, car payments, insurance premiums, and other commitments that are predictable and necessary.

Excel formula for total fixed expenses: =SUM(B2:B7)

The total fixed expenses are calculated by adding up the various categories. Be sure to update these numbers annually or whenever there are changes to these payments, such as rent increases or car insurance renewals.

Step 3: Variable Expenses

Variable expenses change month-to-month and depend on your lifestyle choices. These can include groceries, gas, entertainment, dining out, and other discretionary spending. It’s important to estimate your variable expenses as accurately as possible based on past spending patterns, but it’s also wise to allow for some flexibility.

Formula for total variable expenses: =SUM(B2:B6)

Tracking variable expenses can be a bit trickier since they fluctuate. To estimate these accurately, consider reviewing past bank statements or credit card records. If you find that a particular category tends to be higher, such as entertainment, look for ways to reduce it.

Step 4: Debt Payments

Managing debt is a critical part of budgeting, especially for families who may have student loans, credit card debt, or personal loans. Understanding how much you owe and creating a strategy to pay it off is essential for financial health.

Excel formula for total debt payments: =SUM(B2:B4)

In this section, list all your debt payments and make sure to include the minimum payments for each. If possible, try to allocate extra funds toward high-interest debt to pay it off more quickly. Once your debts are paid off, you can reallocate these funds toward savings or other financial goals.

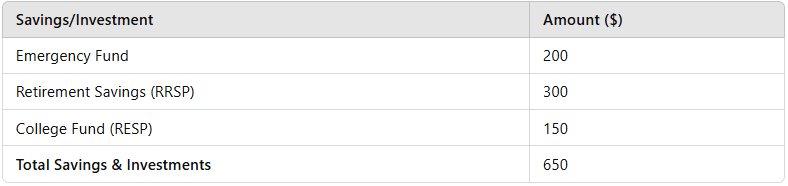

Step 5: Savings & Investments

A budget isn’t just about tracking expenses – it’s also about ensuring that you’re saving and investing for your future. This section should include savings for retirement, emergency funds, and other financial goals.

Excel formula for total savings: =SUM(B2:B4)

Savings should be a priority in your budget. Treat it as a fixed expense by automating contributions to savings accounts or investment portfolios. Setting aside money for an emergency fund, retirement, and specific goals, like a child’s education, will secure your family’s financial future.

Step 6: Summary

The summary section of your family budget spreadsheet is where you calculate whether your spending aligns with your income and whether you are staying within your financial limits. The key numbers to focus on here are your total income, total expenses, and total savings.

Excel formula for net income: =B2-(B3+B4+B5+B6)

If your net income is positive, this means you have extra funds that can be allocated to savings or used to pay down debt more aggressively. If it’s negative, it means that you’re spending more than you’re earning, and you may need to look for areas to cut back.

Insights to Optimize Your Family Budget

Zero-Based Budgeting for Better Control

Zero-based budgeting is an approach where you allocate every single dollar of your income to a specific category. This method helps ensure that no money is wasted, and it forces you to be intentional with your spending. Starting with a goal of having zero remaining after your allocations can make your budgeting process even more disciplined.

Financial Goals to Guide Your Budgeting

Your budget should not only reflect your current situation but also help you plan for the future. Set both short-term goals, like saving for a vacation, and long-term goals, such as retirement or a college fund. Track these goals within your spreadsheet and make monthly contributions towards them.

Handling Irregular Income

For families with unpredictable income streams (e.g., freelancers or seasonal workers), it’s essential to plan for lean months by basing your budget on the lowest income you've received over the past year. Additionally, building an emergency fund can help smooth over any income volatility.

Managing Debt Effectively

There are two primary methods for tackling debt: the debt snowball method, where you focus on paying off the smallest debt first, and the debt avalanche method, where you pay off the highest-interest debt first. Choose the method that works best for your family’s motivation and financial situation.

Automating Your Savings

One of the best ways to stay on track with savings is to automate your contributions. Set up automatic transfers to your emergency fund, retirement accounts, and other savings goals. This ensures that you're saving consistently without having to think about it every month.

Review and Adjust Regularly

Your family’s financial situation is always changing. Make it a habit to review and adjust your budget every few months. This could be due to a salary increase, a change in expenses, or a major life event like having a child or buying a home. Regular adjustments ensure that your budget remains relevant and accurate.

How to Make a Budget Spreadsheet for Your Family

A family budget spreadsheet is more than just a financial tool—it’s the foundation of a well-managed and secure financial life. By tracking income, expenses, debt payments, and savings, you create a roadmap to achieve your financial goals. Zero-based budgeting, tracking financial goals, and automating savings can make this process even more effective.

Remember that budgeting is a dynamic and ongoing process. As your family's circumstances evolve, so should your budget. With a well-organized spreadsheet, consistent review, and disciplined financial habits, your family will be well on its way to a financially stable and prosperous future.