Bank of Canada Interest Rate Announcement September 2024

October 2, 2024

The Bank of Canada's interest rate announcements are closely monitored events that shape the financial landscape for homeowners, businesses, and investors. These announcements provide insight into the central bank's monetary policy decisions, impacting everything from mortgage rates to consumer spending.

For September 2024, the Bank of Canada has taken another pivotal step in its efforts to balance inflation and economic growth. This article delves into the implications of the latest interest rate decision, explores its impact on Canadian homeowners, and provides actionable advice for navigating the changing economic environment.

Bank of Canada Interest Rate Announcements

The Bank of Canada maintained its overnight target rate at X% (adjust to the official rate if available), aligning with market expectations. This decision reflects ongoing efforts to control inflation, which has been hovering around the central bank's target of 2%.

Why the Rate Decision Matters

The overnight rate is a key benchmark that influences borrowing costs across the economy. It directly affects:

Variable Mortgage Rates: Tied to the prime rate, which fluctuates with the Bank of Canada's overnight rate.

HELOCs and Personal Loans: Variable products like Home Equity Lines of Credit adjust based on interest rate changes.

Consumer Confidence: Higher borrowing costs can dampen spending, while lower rates can stimulate economic activity.

Economic Context

As of September 2024, the Canadian economy is grappling with a mix of factors:

Inflationary Pressures: Although inflation has eased from pandemic-induced highs, certain sectors like housing and energy remain volatile.

Labor Market Trends: Unemployment rates are steady, but wage growth has slowed, impacting consumer purchasing power.

Global Factors: External uncertainties, including trade tensions and currency fluctuations, influence the Bank of Canada's decisions.

Impact on Canadian Homeowners

Interest rate decisions significantly affect Canadian homeowners, particularly those with variable-rate mortgages or those considering refinancing or accessing a HELOC.

1. Variable-Rate Mortgages

Homeowners with variable-rate mortgages will see immediate changes to their monthly payments. For example:

If the overnight rate remains at X%, and your mortgage balance is $400,000 at a prime rate of Y%, a 0.25% increase could result in an additional $50 per month in interest payments.

2. Fixed-Rate Mortgages

While fixed rates are not directly tied to the overnight rate, they respond to bond market trends. Homeowners looking to renew or secure new fixed-rate mortgages should keep an eye on bond yields, which are influenced by the Bank of Canada's policy stance.

3. HELOCs and Credit Lines

The cost of borrowing through a HELOC or other variable-rate credit products will adjust in line with rate changes. For example, a homeowner borrowing $50,000 through a HELOC could see monthly interest costs rise from $208 to $229 with a 0.25% rate hike.

4. Affordability Challenges

Higher interest rates mean increased monthly payments, reducing affordability for prospective buyers. Homeowners may also face challenges when renewing their mortgages, as they adjust to new, higher rates.

Strategies for Canadian Homeowners

With the Bank of Canada's September 2024 announcement reinforcing a higher-rate environment, Canadian homeowners should consider these strategies to mitigate financial strain:

1. Review Your Budget

Higher borrowing costs mean it's time to revisit household budgets. Identify areas to cut discretionary spending and allocate funds toward debt repayment or savings.

2. Lock in Fixed Rates

If you're currently in a variable-rate mortgage and expect further rate hikes, consider switching to a fixed-rate mortgage for stability. Consult with a mortgage broker to weigh the pros and cons based on your financial goals.

3. Accelerate Debt Repayment

Paying down high-interest debts, like HELOCs or credit cards, can save significant money over time. Focus on reducing variable-rate debt first, as these costs rise with each rate hike.

4. Explore Refinancing Options

Homeowners with significant equity may benefit from refinancing to secure better terms or consolidate higher-interest debts. For instance, refinancing a $300,000 mortgage from 6% to 5% could save approximately $3,000 annually in interest.

Broader Economic Implications

The Bank of Canada's decision affects more than just homeowners. Here's how the September 2024 rate announcement ripples through the economy:

Business Borrowing Costs: Higher rates can lead to reduced investments and slower growth, especially for small and medium-sized enterprises relying on loans.

Consumer Spending: With higher borrowing costs, consumers may pull back on large purchases, affecting retail and service industries.

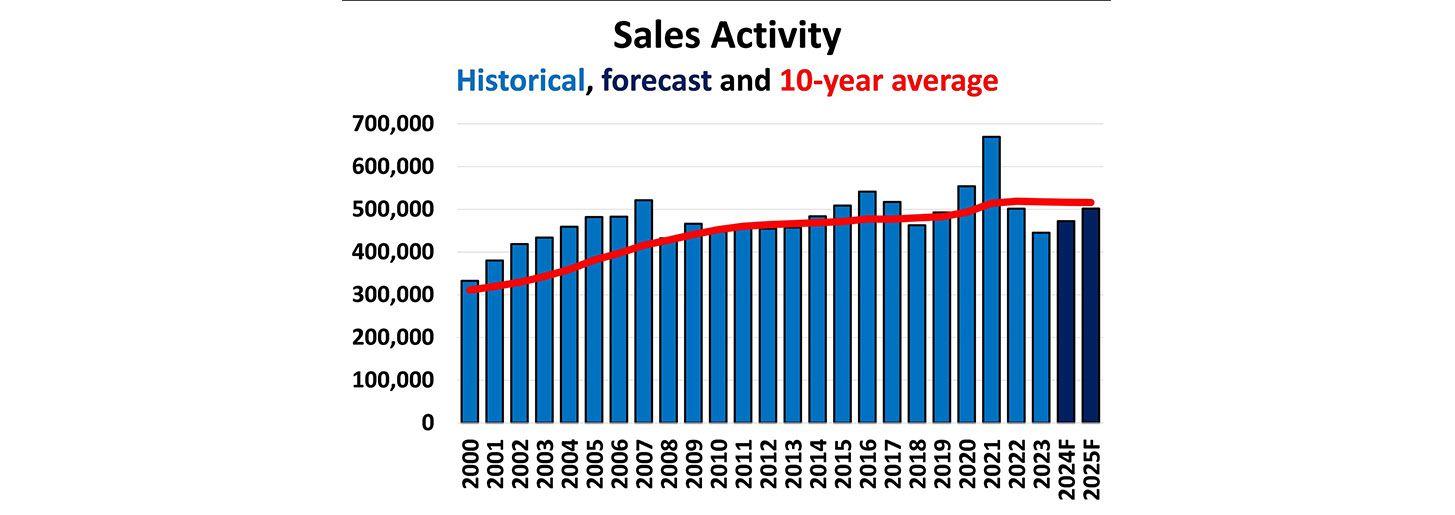

Housing Market: Increased mortgage costs can cool housing demand, potentially leading to slower price growth or price corrections in overheated markets.

Currency Strength: Higher rates can attract foreign investment, strengthening the Canadian dollar. While this benefits importers, it can pose challenges for exporters.

Preparing for Future Rate Decisions

The Bank of Canada's monetary policy is guided by its dual mandate to control inflation and promote economic growth. Here's how you can prepare for potential rate changes:

Stay Informed: Regularly monitor economic indicators, such as inflation rates, GDP growth, and unemployment figures, which influence future rate decisions.

Consult Professionals: Mortgage brokers, financial planners, and investment advisors can provide tailored advice to optimize your financial strategy in a high-rate environment.

Diversify Income Sources: Consider generating additional income through side hustles, investments, or rental properties to offset rising costs.

Interest Rate Announcement September 2024

The Bank of Canada's September 2024 interest rate announcement underscores the importance of proactive financial planning. Whether you're managing a mortgage, considering a HELOC, or simply navigating the broader economic landscape, understanding the implications of rate decisions is key to financial success.

By staying informed, working with professionals, and adopting strategic financial practices, Canadian homeowners can weather the challenges of a higher-rate environment while positioning themselves for long-term stability and growth.

Get Personalized Advice

with an Award-Winning Mortgage Broker